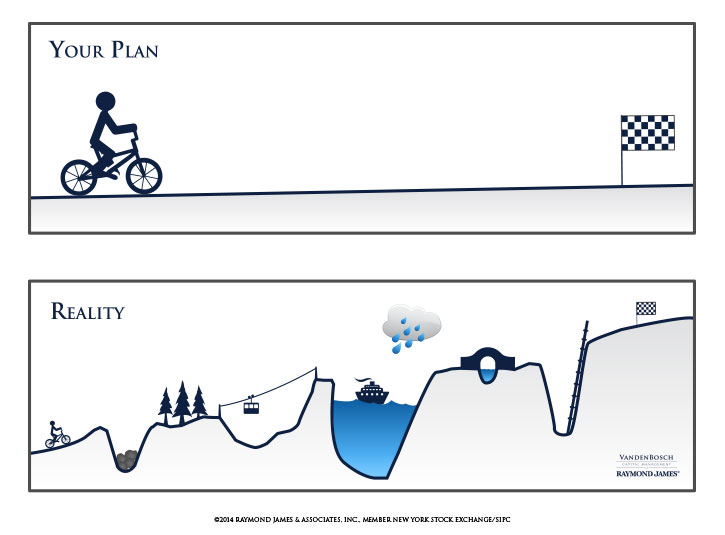

Markets are always full of uncertainty and that is why having a tested investment process is so important. Troy refers to this as process over prediction. This process includes these key features:

- Predicting the exact future path of events is not required to make money in the markets. Instead, Troy’s focus is on staying in sync with the market and adjusting over time as the risk vs reward picture changes.

- Aiming to avoid major market declines by managing risk properly and following the fundamentals.

- Appreciating that everyone’s risk tolerance and time horizon is different. Focusing on the long term means something completely different to someone who is 45 vs someone who is 85.

- Understanding that hope is not an investment strategy and that “just ride it out” is not always a sound investment plan when the market gets rough.

- Investing conservatively, tax efficiently, and avoiding fads has proven to be a time-tested strategy.

Troy considers his investment planning process to be a worthy alternative to traditional asset allocation or buy-and-hold strategies. There are investment managers who attempt to forecast market highs and lows over a period of 20 years or so, but he prefers a more practical approach – planning for performance two years out.

Troy believes it helps ensure that he’s making tactical decisions about your investments on a more ongoing basis, designed to limit exposure to volatility and mitigate client stress. In addition to offering this thoughtful alternative to traditional investment strategies, he is attuned to the word on the street. The louder the media clamor is on any financial issue, the more skeptical he is.

There is no assurance any investment strategy will be successful. Investing involves risk and investors may incur a profit or a loss.